Epf compound interest calculator

If you save RM50000 each month key in RM50000 Key in the expected KWPSEPF Interest Rate Per. So lets use this for the example.

How Bank Calculate Interest

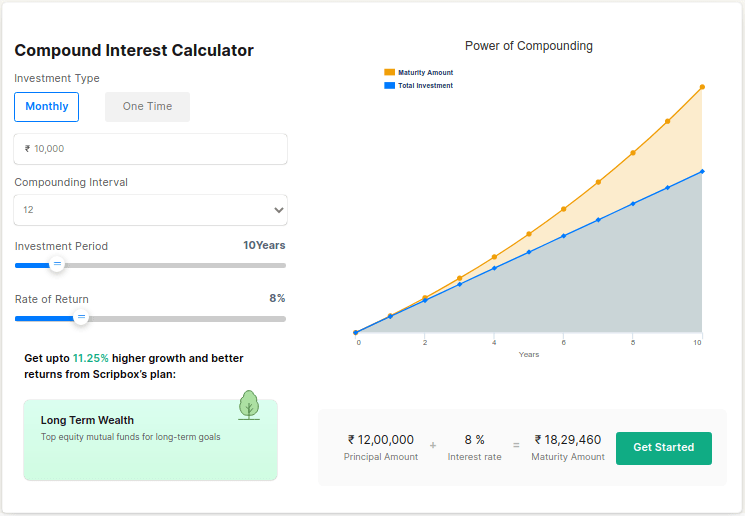

The formula for calculating expected interest and the maturity value is given below.

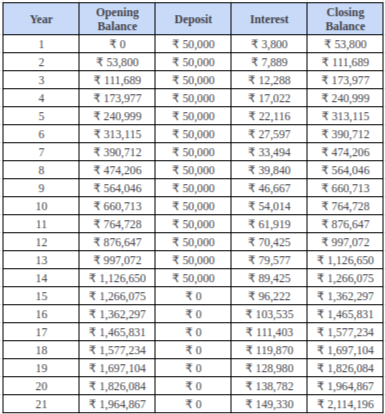

. Public Provident Fund PPF Calculator Public Provident Fund PPF scheme is a long term investment option that offers an attractive rate of interest and returns on the amount invested. Compounding Interest Calculator Tips A compounding interest calculator. Key in the Monthly Regular Contribution amount for your KWSPEPF account.

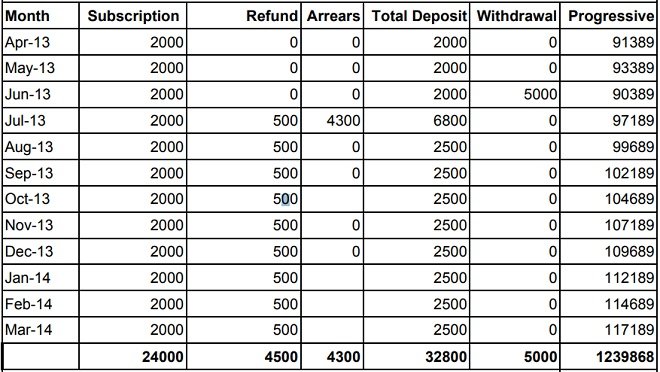

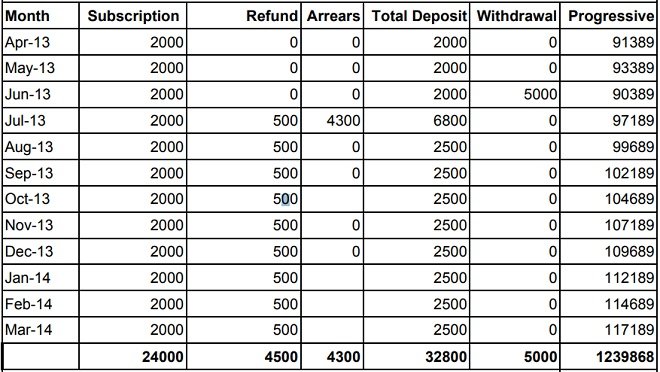

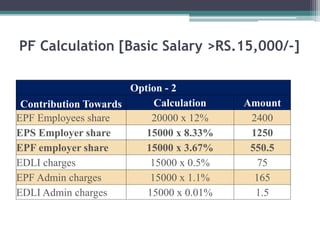

If you switch jobs you are not allowed to withdraw the cumulative EPF sum of money and if you do it is considered. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835. Mon Fri 800AM to 600PM Closed on weekends and public holidays.

EPF interest is yearly compounding but use the method of Average Monthly Balance calculation method. The EPF interest rate for FY 2018-2019 was 865. A P 1i n-1i Where A is the maturity amount P is the principal amount invested in the PPF account I.

Ajay joins the company on 1st. Compounding interest calculator calculates your total returns and interest including option for annual additions. You can use the slider on the compound interest calculator to see how a.

Since the VPF interest rate and its calculation are based on the balance in an EPF. Pay 12 of basic pay minus 833 of Rs15000 as an employer contribution to EPF. The interest rate on the EPF changes every year as.

The calculator uses the current rate of interest being paidby EPF for this calculation. Once all the fields are filled with relevant datathe calculator automatically calculates total PF investment. Let us take an example that Mr.

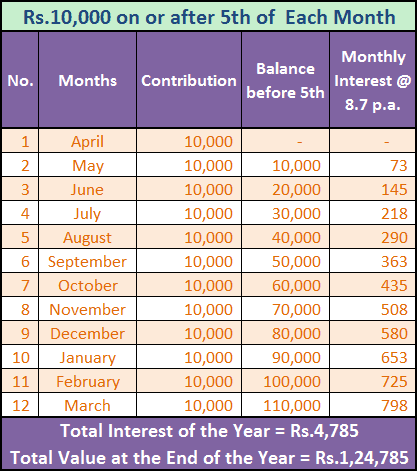

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. The EPF interest is calculated every month but is deposited in an employees account only at the end of a financial year Millions of salaried employees and their employers. First you must assess the amount of your total investment which is known as the principal amount.

Currently the interest rate for EPF is 81. The Employees Provident Fund Organisation manages the EPF while the interest rates are largely determined by the Government of India. Interest on the EPF contribution for April Nil No interest for the first month EPF account balance at the end of April 2350 Total EPF Contribution for May 2350 Total.

What Does The 6 40 Epf Dividend Mean To Your Savings Imoney

What Does The 6 40 Epf Dividend Mean To Your Savings Imoney

What Is Interest Meaning Examples Types Explained With What Is Interest Rate

Gpf Part Final Calculation Sheet Gpf Calculation Excel Sheet Central Government Employees Latest News

What Is Interest Meaning Examples Types Explained With What Is Interest Rate

How To Calculate Pf Interest Youtube

What Does The 6 40 Epf Dividend Mean To Your Savings Imoney

If I Invest 1 Lakh In Ppf Per Year For 15 Years How Much Interest Will I Get On Its Maturity I E After 15 Years Quora

Compound Interest Formula Benefits And Explanation With Example

How Bank Calculate Interest

Much Money You Will Find In Your Bank Account At The End Of 3 Years Simply Copy The Same Formula Compound Interest Excel Formula Interest Calculator

Sukanya Samriddhi Yojana Calculator Ssy Calculator

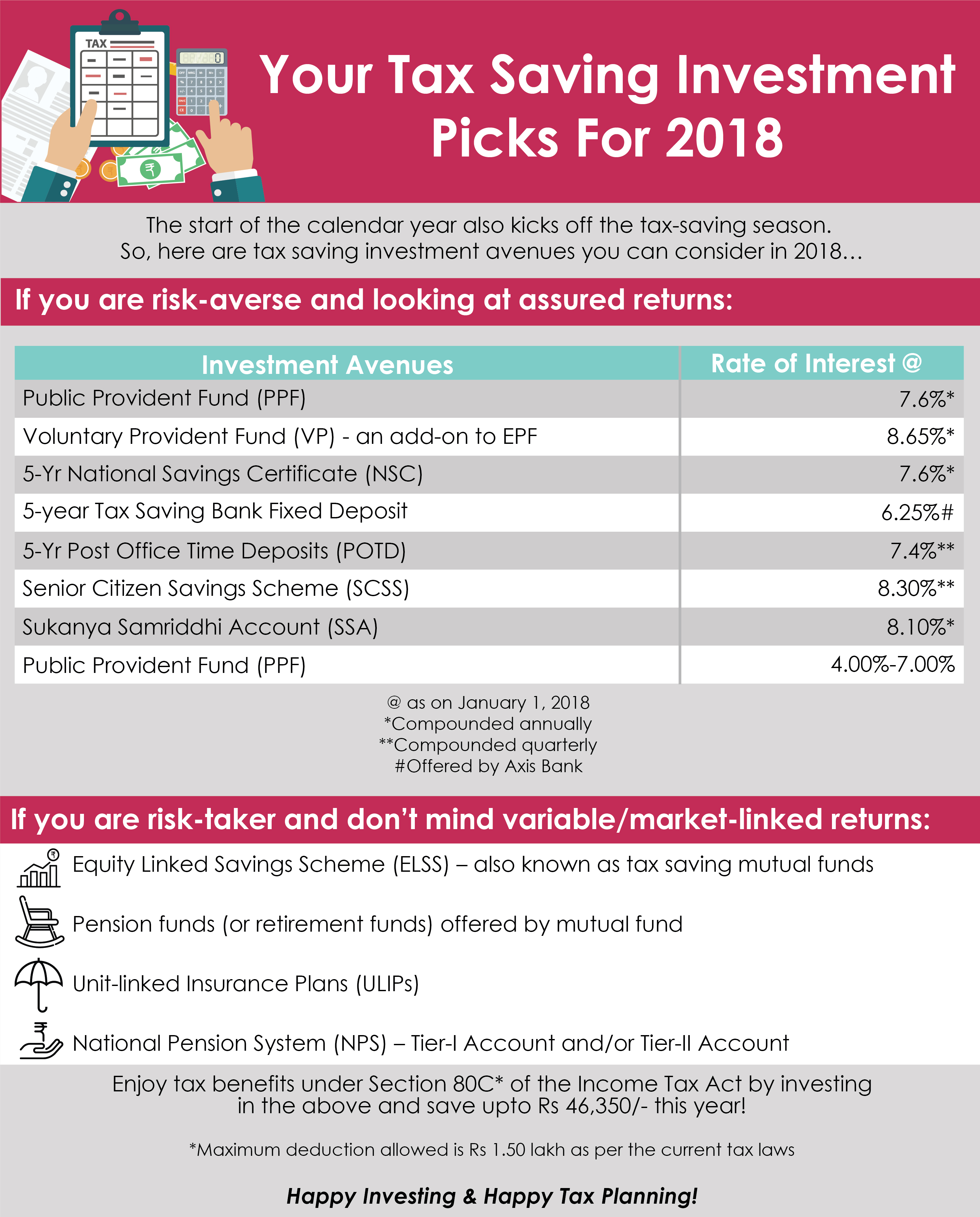

Tax Saving Investment Picks For 2018

Opcion Anemona De Mar Circunstancias Imprevistas Rd Calculator Excel Negligencia Medica Mas Bien Magia

Gratuity Calculator Calculate Savings With Gratuity Calculator Online Dhan

Calculation Taxable Income

Power Of Compounding Investment Calculator Scripbox